Are crypto investments risky? In this interview, BrainTrust shares their experiences.

Please tell us what BrainTrust does exactly.

Lotus Fund, Brain Trust, is the company behind Summer Foot.

With Lotus Fund, we invest funds in FIAT currency, almost exclusively euros, on so-called crypto-lending platforms, on which we then receive fixed, as well as variable interest rates depending on certain parameters.

We then invest this interest income directly in cryptocurrencies at regular intervals in order to build up an impressive portfolio of crypto assets in the long term, without directly taking the risk of the sometimes strong volatility of cryptocurrencies with the initial capital.

https://www.longtermtrends.net/ethereum-vs-bitcoin/

The crypto market is a fascinating business model, but it has also been subject to some strong turbulence in recent months. How do you assess the current situation and is there an impact on the cooperation with Melchers/the capital under management?

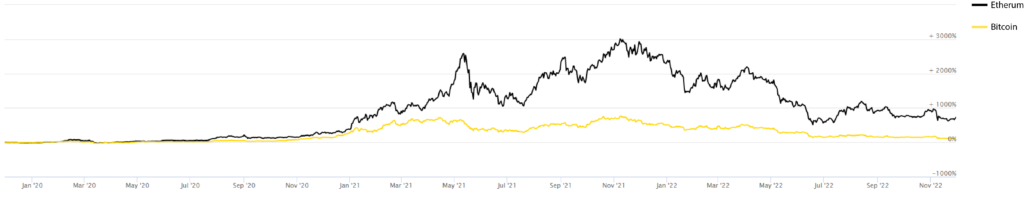

We think that the long-term upward trend in the crypto market is intact, especially for Bitcoin and Ethereum as well as other, already more mature blockchain projects.

Due to the generally very unstable global macroeconomic situation, the crypto market has also been severely affected in recent months. Fundamentally, there is little justification for this in our eyes for stocks like Ethereum. Psychologically, however, crypto and traditional markets are still very closely intertwined. Therefore, we also see further downward pressure in the crypto market in the upcoming weeks, as this is primarily driven by generally poor economic developments, such as high inflation rates worldwide, among others. In terms of investment strategy, we withdrew the invested capital completely from the platforms in the past three months to ensure maximum security for our fund in such times. As soon as we believe the situation has stabilized more, we will actively place funds again.

Are there any further plans to expand the business model? Are you interested in opening up to external investors?

In principle, yes, but nothing concrete so far.

Thank you for the interview! We are looking forward to hearing about future developments in this area.

If you are interested in working with us, contact us at: contact@melchers.de

#melchers #trading #mmes #yourpartnerinasia #blog #crypto #bitcoin #etherum